Reigo Vulnerability Index™

In the US short term real estate debt market, where investment decisions continue to be made without using data science - Reigo is the leading AI-powered asset manager providing the optimal proven empiric results.

Our solutions

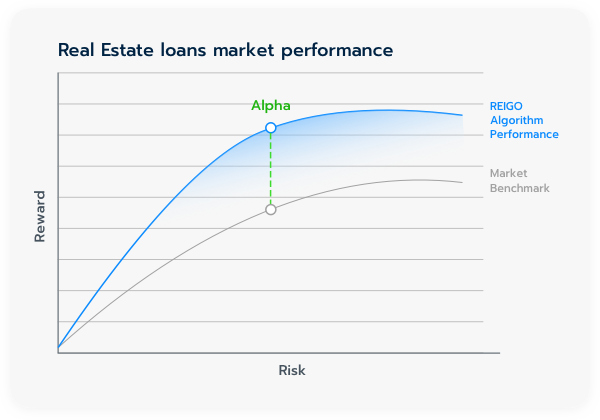

Outperforming Common Performance Benchmarks Using AI

We use machine learning and new big data technologies to analyze a multitude of data sources in order to find, score and select the best loans available, providing better risk-adjusted returns to investors.

The Technology

We Use Data Science to:

Reduce defaults

9% 2%Reduce underwriting time

Days HoursIncrease model update frequency

Infrequent Weekly BasisIncrease Geo diversification

Local NationalActive Investments

1727

Total loans

1017

Paid-off loads

2.5%

Non-performing loans

0%

Principal Loss